NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN ART DIRECTLY OR INDIRECTLY, IN OR INTO AUSTRALIA, CANADA, JAPAN, HONG KONG, SOUTH AFRICA OR THE UNITED STATES OR ANY OTHER JURISDICTION IN WHICH THE RELEASE, PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL. THIS ANNOUNCEMENT DOES NOT CONSTITUTE AN OFFER OF ANY OF THE SECURITIES DESCRIBED HEREIN.

Ocean Sun AS: Contemplated Private Placement and admission to trading on Merkur Market

Ocean Sun AS (the “Company”) has engaged Fearnley Securities AS as manager and bookrunner (the “Manager”) to advise on and effect a contemplated private placement of new ordinary shares (“New Shares”) in the Company with gross proceeds of approximately NOK 100 million, and a secondary sale of existing shares by existing shareholders in the Company (the “Selling Shareholders”) of up to 2,745,100 shares in the Company with gross proceeds of up to NOK 50 million (“Secondary Shares”, and together with the New Shares, the “Offer Shares”) (the “Private Placement”). The price (the “Offer Price”) at which the Offer Shares will be sold is expected to be between NOK 17.75 and NOK 20.25 per Offer Share (the “Indicative Price Range”). The Offer Price may be set within, below or above the Indicative Price Range. The Offer Price and the number of Offer Shares to be sold will be determined through a bookbuilding process and will be set by the Company’s board of directors (the “Board”), in consultation with the Manager after completion of the application period.

The net proceeds from the issue of the New Shares are expected to be used expand the organization, fund continued research and development, as well as working capital and general corporate purposes. The net proceeds from any sale of Secondary Shares will be for the benefit of the Selling Shareholders.

The application period in the Private Placement will commence today, 12 October 2020 at 09:00 CEST and close on 16 October 2020 at 16:30 CEST. The Company may, however, at any time resolve to close or extend the application period without notice. If the application period is shortened or extended, any other dates referred to herein may be amended accordingly.

The Company has applied for, and expects, subject to successful completion of the Private Placement and the necessary approvals from the Oslo Stock Exchange, having its shares admitted to trading on Merkur Market, a multilateral trading facility operated by the Oslo Stock Exchange. The first day of trading on Merkur Market is expected to be shortly after completion of the Private Placement, and is currently anticipated to be on or about 26 October 2020.

The Private Placement will be directed towards Norwegian and international investors (a) outside the United States, subject to applicable exemptions from any prospectus and registration requirements and in reliance on Regulation S. under the U.S, Securities Act, and (b) to investors in the United States who are QIBs as defined in, and in reliance on, Rule 144A under the U.S. Securities Act, in each case subject to an exemption being available from offer prospectus requirements and any other filing or registration requirements in the applicable jurisdictions and subject to other selling restrictions. The minimum application and allocation amount has been set to the NOK equivalent of EUR 100,000 per investor. The Company may, however, at its sole discretion, allocate an amount below EUR 100,000 to the extent applicable exemptions from the prospectus requirement pursuant to the Norwegian Securities Trading Act and ancillary regulations are available. Further selling restrictions and transaction terms will apply.

Completion of the Private Placement is subject to (i) all corporate resolutions of the Company required to implement the Private Placement being validly made, including the Company’s board of directors’ resolution (and the general meeting of the Company if required) to proceed with the Private Placement and to issue the New Shares, (ii) payment being received for the Offer Shares, (iii) registration in the Norwegian Register of Business Enterprises of the share capital increase pertaining to the New Shares, and (iv) the Company’s shares being approved for admission to trading on Merkur Market. There can be no assurance that these conditions will be satisfied. If the conditions are not satisfied, the offering may be revoked or suspended without any compensation to applicants.

The Company reserves the right, at any time and for any reason, to cancel, and/or modify the terms of, the Private Placement. Neither the Company, the Selling Shareholders nor the Manager will be liable for any losses incurred by applicants if the Private Placement is cancelled, irrespective of the reason for such cancellation.

About Ocean Sun:

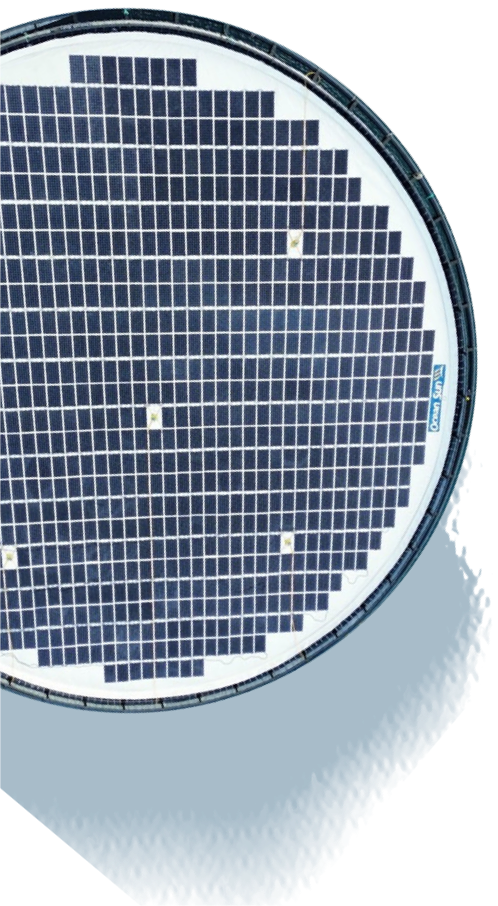

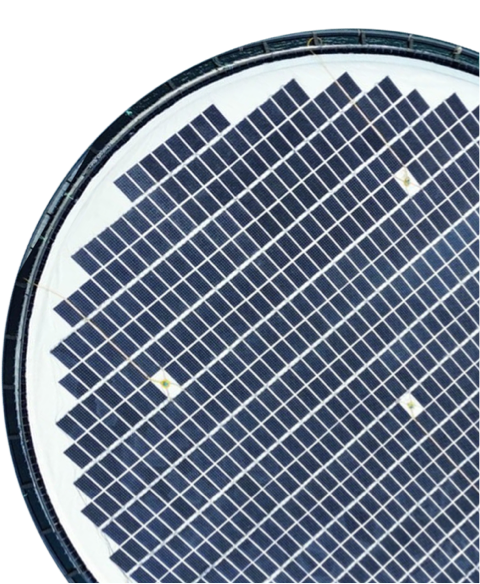

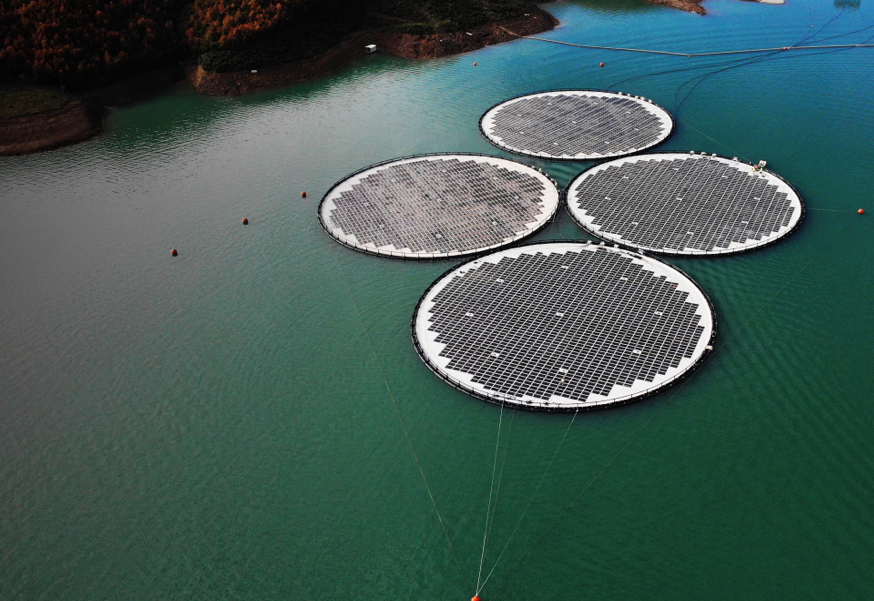

By combining the Norwegian maritime expertise and knowledge within silicon photovoltaics, Ocean Sun has developed an innovation that offers a bold solution to our global energy needs. The patented technology is based on solar modules mounted on hydro-elastic membranes and offers cost and performance benefits not seen in any other floating PV system today.

With offices in Oslo, Singapore and Shanghai, Ocean Sun is embarking on its vision to be the world’s leading technology provider of floating solar.

Advisors:

The Company has appointed Fearnley Securities AS to act as manager and bookrunner in the Private Placement. Advokatfirmaet BAHR AS is acting as legal advisor to the Company.

For more information, please contact:

Børge Bjørneklett, Chief Executive Officer

+47 901 95 778

Karl Lawenius, Chief Financial Officer

+47 456 33 881

IMPORTANT NOTICE

The information contained in this announcement is for background purposes only and does not purport to be full or complete. No reliance may be placed for any purpose on the information contained in this announcement or its accuracy, fairness or completeness. None of the Manager or any of their respective affiliates or any of their respective directors, officers, employees, advisors or agents accepts any responsibility or liability whatsoever for, or makes any representation or warranty, express or implied, as to the truth, accuracy or completeness of the information in this announcement (or whether any information has been omitted from the announcement) or any other information relating to the Company, its subsidiaries or associated companies, whether written, oral or in a visual or electronic form, and howsoever transmitted or made vailable, or for any loss howsoever arising from any use of this announcement or its contents or otherwise arising in connection therewith. This announcement has been prepared by and is the sole responsibility of the Company.

Neither this announcement nor the information contained herein is for publication, distribution or release, in whole or in part, directly or indirectly, in or into or from the United States (including its territories and possessions, any State of the United States and the District of Columbia), Australia, Canada, Japan, Hong Kong, South Africa or any other jurisdiction where to do so would constitute a violation of the relevant laws of such jurisdiction. The publication, distribution or release of this announcement may be restricted by law in certain jurisdictions and persons into whose possession any document or other information referred to herein should inform themselves about and observe any such restriction. Any failure to comply with these restrictions may constitute a violation of the securities laws of any such jurisdiction.

This announcement does not contain or constitute an offer to sell or a solicitation of any offer to buy or subscribe for any securities referred to in this announcement to any person in any jurisdiction, including the United States, Australia, Canada, Japan, Hong Kong or South Africa or any jurisdiction to whom or in which such offer or solicitation is unlawful.

The securities referred to in this announcement have not been and will not be registered under the U.S. Securities Act of 1933, as amended (the “U.S. Securities Act”), and may not be offered or sold in the United States absent registration or an exemption from, or in a transaction not subject to, the registration requirements of the U.S. Securities Act and in accordance with applicable U.S. state securities laws. The Company do not intend to register any securities referred to herein in the United States or to conduct a public offering of securities in the United States.

Any offering of the securities referred to in this announcement will be made by means of a set of subscription materials provided to potential investors. Investors should not subscribe for any securities referred to in this announcement except on the basis of information contained in the aforementioned subscription material.

In any EEA Member State, this communication is only addressed to and is only directed at qualified investors in that Member State within the meaning of the EU Prospectus Regulation, i.e., only to investors who can receive the offer without an approved prospectus in such EEA Member State. The expression “EU Prospectus Regulation” means Regulation (EU) 2017/1129 of the European Parliament and of the Council of 14 June 2017 (together with any applicable implementing measures in any Member State).

This communication is only being distributed to and is only directed at persons in the United Kingdom that are Qualified Investors and that are (i) investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the “Order”) or (ii) high net worth entities, and other persons to whom this announcement may lawfully be communicated, falling within Article 49(2)(a) to (d) of the Order (all such persons together being referred to as “relevant persons”). This communication must not be acted on or relied on by persons who are not relevant persons. Any investment or investment activity to which this communication relates is available only to relevant persons and will be engaged in only with relevant persons. Persons distributing this communication must satisfy themselves that it is lawful to do so.

This announcement is made by, and is the responsibility of, the Company. The Manager and their affiliates are acting exclusively for the Company and no-one else in connection with the Private Placement. They will not regard any other person as their respective clients in relation to the Private Placement and will not be responsible to anyone other than the Company, for providing the protections afforded to their respective clients, nor for providing advice in relation to the Private Placement, the contents of this announcement or any transaction, arrangement or other matter referred to herein.

In connection with the Private Placement, the Manager and any of their affiliates, acting as investors for their own accounts, may subscribe for or purchase shares and in that capacity may retain, purchase, sell, offer to sell or otherwise deal for their own accounts in such shares and other securities of the Company or related investments in connection with the Private Placement or otherwise. Accordingly, references in any subscription materials to the shares being issued, offered, subscribed, acquired, placed or otherwise dealt in should be read as including any issue or offer to, or subscription, acquisition, placing or dealing by, such Manager and any of their affiliates acting as investors for their own accounts. The Manager do not intend to disclose the extent of any such investment or transactions otherwise than in accordance with any legal or regulatory obligations to

do so.

Matters discussed in this announcement may constitute forward-looking statements. Forwardlooking statements are statements that are not historical facts and may be identified by words such as “believe”, “aims”, “expect”, “anticipate”, “intends”, “estimate”, “will”, “may”, “continue”, “should” and similar expressions. The forward-looking statements in this release are based upon various assumptions, many of which are based, in turn, upon further assumptions. Although the Company believes that these assumptions were reasonable when made, these assumptions are inherently subject to significant known and unknown risks, uncertainties, contingencies, and other important factors which are difficult or impossible to predict and are beyond its control. Such risks, uncertainties, contingencies, and other important factors could cause actual events to differ materially from the expectations expressed or implied in this release by such forward-looking statements. Forward-looking statements speak only as of the date they are made and cannot be relied upon as a guide to future performance. The Company, each of the Manager and their respective affiliates expressly disclaims any obligation or undertaking to update, review or revise any forward-looking statement contained in this announcement whether as a result of new information, future developments or otherwise. The information, opinions and forward-looking statements contained in this announcement speak only as at its date and are subject to change without notice.

The Private Placement and the contemplated admission to trading on Merkur Market may be influenced by a range of circumstances, such as market conditions, and there is no guarantee that the Private Placement will proceed and that the admission to trading on Merkur Market will occur.

This announcement is for information purposes only. It does not purport to be complete, and it is not to be relied upon in substitution for the exercise of independent judgment. It is not intended as investment advice and under no circumstances is it to be used or considered as an offer to sell, or a solicitation of an offer to buy any securities or a recommendation to buy or sell any securities of the Company. Neither the Manager nor any of their respective affiliates accepts any liability arising from the use of this announcement. The Company and the Manager, and their respective affiliates, expressly disclaims any obligation or undertaking to update, review or revise any statement contained in this announcement whether as a result of new information, future developments or otherwise.

The distribution of this announcement and other information may be restricted by law in certain jurisdictions. Persons into whose possession this announcement or such other information should come are required to inform themselves about and to observe any such restrictions.